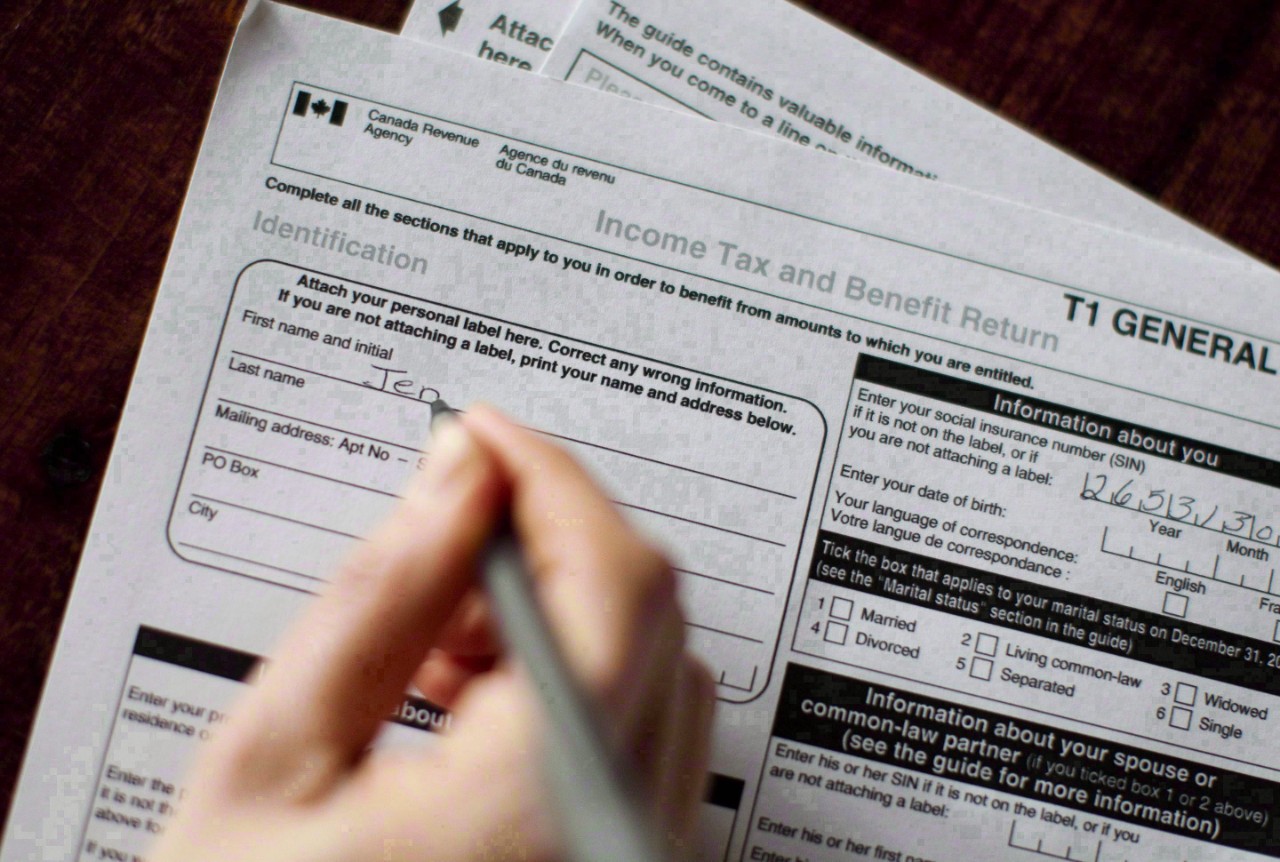

T1 Individual Return

T1 Individual Return – Anyone with a relatively complicated tax situation can benefit from hiring a professional. For Example, if you have had multiple sources of income, hold investment accounts, purchased a home, medical expenses, or shared custody of dependents, it may be worth paying someone who can help you navigate your return, maximize the tax breaks you’re entitled to, avoid errors and understand what to expect.

In many cases, you will find that the fee you pay to hire a professional makes up for itself in tax savings you otherwise would not have uncovered yourself. Just as importantly, when you hire a professional, you usually get the benefit of audit report should the CRA question your return down the line. That is a very good thing to have.

Hiring someone who knows the tax code inside and out is a great way to give yourself added peace of mind, too. And that alone is a good reason to spend a little extra money.

Employment Expenses: If your job both pays and costs you money, you may be eligible to claim some of these expenses. Most taxpayers cannot write off work related expenses if the expenses are required as part of your employment, you may be in luck.

Eligible Expenses

CRA has a complete list of all expenses you’re allowed to claim as part of your job. To claim the expenses, you’ll need a T2200 issued by your employer, to complete a T777.

- Tools for tradespersons, mechanics, apprentices, and forestry workers.

- Vehicle expenses if you are required to travel for your employment.

- Workspace-in-the-home expenses such as the cost of internet, computers, or office supplies.

- Meals and lodging expenses for transportation industry workers such as long-haul truckers.

Commission-based employee, your list of possible employment expenses also includes

- food and beverages for yourself if you are away from home,

- entertainment expenses for clients,

- car expenses, travel costs and overnight stays on business trips.

Get in Touch

Other Services We Offer

Bookkeeping

Handling your accounting and providing you with financial reports.

Small Business Taxes

We can help you prepare and file your small business taxes including your T2 business tax return and much more.

QuickBooks Consulting

We can help your business utilize QuickBooks™ to its fullest potential.

Personal Tax Return

Our clients have access to experience tax consultants, even after the personal tax returns are completed. Our accountants specialize in T4, T4A filing and much more.

Tax Preparation

Our licensed tax preparers can prepare your personal and business tax returns.

Other Services

Our team also provides a variety of other financial advisory services.

Get Your Taxes Filed The Right Way

within IN 60 mins